Employment numbers are approaching their pre-pandemic levels, and many families have been able to weather the worst of the pandemic financially intact. However, a recent national poll by NPR, the Robert Wood Johnson Foundation, and the Harvard T.H. Chan School of Public Health found that 38 percent of households reported serious financial problems in the last few months. The poll reveals new insights into how Americans are faring financially after the most recent Delta variant surge, and the serious implications for Americans’ ability to stay securely housed.

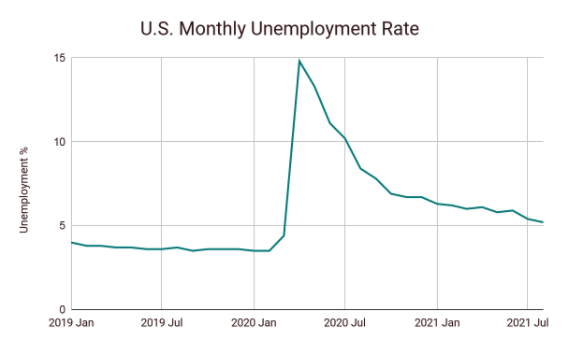

Civilian unemployment rate from the U.S. Bureau of Labor Statistics

The federal government has devoted tens of billions of dollars to rent relief, but only about 16 percent of those funds have been dispersed to renters in need. When the Supreme Court struck down the Center for Disease Control’s eviction moratorium in August of this year, 27 percent of renters reported serious problems paying rent in the last few months.

With such a persistent level of need, organizations at the community level have done their best to help people make ends meet and weather the economic challenges of the pandemic. In the last three months, findhelp recorded over 130,000 housing service referrals across the country. These services include people seeking rent or utility assistance, temporary shelter, and help finding housing.

Thirty-eight percent of households reported serious financial problems in the last few months.

The financial impact has been significantly worse for Black Americans and other communities of color. Among Latino, Black, and Native American households, 50 percent reported having serious financial problems. In fact, almost one in three Black households reported losing all of their savings during the pandemic, compared to one in five households nationally.

The Center for Budget and Policy Priorities highlighted this disproportionate racial impact in their report, Tracking the COVID-19 Economy’s Effects on Food, Housing, and Employment Hardships: “The impacts of the pandemic and the economic fallout have been widespread, but remain particularly prevalent among Black adults, Latino adults, and other people of color. These disproportionate impacts reflect harsh, long-standing inequities — often stemming from structural racism — in education, employment, housing, and health care that the current crisis has exacerbated.”

In the last three months, findhelp recorded over 130,000 housing service referrals across the country.

The report goes on to discuss the increasing amount of overdue rent payments for millions of Americans. Although the number of American households who owe rental debt is down to 13 percent from a peak of 20 percent, in January, the report highlights that “renters of color and families with children have consistently reported higher rates of rent hardship throughout 2020 and 2021.”

While some of the federal pandemic-recovery legislation, like the expanded child tax credit, provide immediate relief to some of those most financially impacted, other recovery efforts have suffered from overly complex administrative requirements.

In the case of the rental assistance program, this has led to a number of new federal policies to reduce the administrative burden, like allowing applicants to self-attest the various eligibility requirements rather than requiring the submission of burdensome documentation.

Whether or not millions of Americans are able to pay their rent and avoid eviction may depend on the efficient administration of these programs.